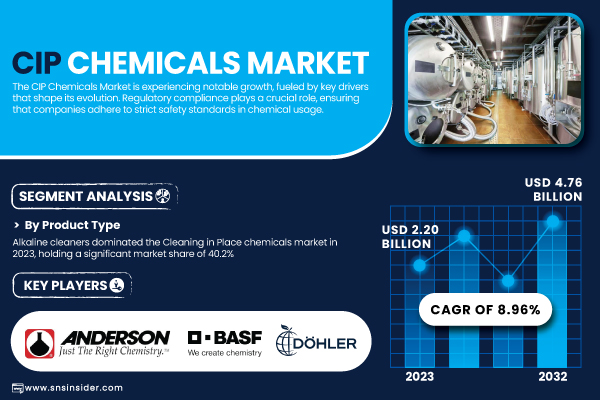

CIP Chemicals Market to Expand at 8.96% CAGR, Reaching USD 4.76 Billion by 2032 | Report by SNS Insider

Stringent hygiene regulations and increasing automation in food processing drive the global demand for CIP Chemicals, enhancing cleaning efficiency and safety.

Austin, March 27, 2025 (GLOBE NEWSWIRE) — The SNS Insider report indicates that, “The CIP Chemicals Market Size was valued at 2.20 Billion in 2023 and is expected to reach USD 4.76 Billion by 2032, growing at a CAGR of 8.96% over the forecast period of 2024-2032.”

Rising Demand for Advanced CIP Solutions Amid Stringent Hygiene Regulations and Sustainable Practices

The CIP Chemicals market is witnessing substantial growth, driven by stringent hygiene regulations, automation in processing industries, and sustainability initiatives. Regulatory bodies like the FDA and EFSA emphasize compliance, prompting increased adoption in food, beverage, pharmaceutical, and biotechnology sectors. In 2023, nearly 60% of EU food processing plants implemented CIP solutions for enhanced sanitation. Leading beverage companies, including Coca-Cola and Nestlé, invest in sustainable CIP systems to optimize water use and mitigate contamination risks. Additionally, Ecolab introduced enzyme-based CIP chemicals in 2022, boosting efficiency while reducing environmental impact. The pharmaceutical industry is also embracing CIP technologies, with a 30% rise in sterile drug manufacturing installations from 2022 to 2024, as reported by the EMA. As industries prioritize sanitation and eco-friendly solutions, the CIP Chemicals market is set for strong expansion.

The US CIP Chemicals Market Size was valued at 0.31 Billion in 2023 and is expected to reach USD 0.63 Billion by 2032, growing at a CAGR of 8.43% over the forecast period of 2024-2032.

The U.S. CIP Chemicals market is growing due to strict hygiene regulations, automation in cleaning, and rising sanitation awareness post-COVID-19. Industries like food, beverage, and pharmaceuticals are adopting advanced CIP solutions for efficiency and compliance. For instance, Ecolab’s collaboration with Tennant Company introduced robotic cleaning systems with chemical dispensing technology. With regulatory bodies emphasizing cleanliness and sustainability, demand for effective CIP solutions continues to rise across key industrial sectors.

Download PDF Sample of CIP Chemicals Market @ https://www.snsinsider.com/sample-request/6091

Key Players:

- Anderson Chemical Company (ProClean CIP, ProClean Alka CIP)

- BASF SE (Sokalan CP 5, Trilon M)

- CCL Pentasol (Pentasol CIP Cleaner, Pentasol Acid Detergent)

- Christeyns (Acifoam, Neutrafoam)

- DeLaval Inc. (DeLaval CIP Super, DeLaval Acid Cleaner)

- Diversey Holdings, Ltd. (Divo CIP, Diverclean Sonic)

- Döhler Group (Döhler CIP Acid, Döhler CIP Caustic)

- Ecolab Inc. (Horolith CIP, P3-Ultrasil)

- FINK TEC GmbH (FINK Alka CIP, FINK Desana CIP)

- Hydrite Chemical Co. (Hydri-Clean CIP, Hydri-San 100)

- Kersia Group (CIP Alkaline, CIP Acid)

- Neogen Corporation (Acid-A-Foam, BioSentry 904)

- Novozymes A/S (Medley Enzymatic Cleaner, Carezyme)

- Quat-Chem Ltd. (Quat-Chem CIP 200, Quat-Chem Acid CIP)

- Sanosil Ltd. (Sanosil S015, Sanosil Super 25)

- Spartan Chemical Company, Inc. (High Acid Cleaner FP, Spartan CIP Alkaline)

- Steris Corporation (Steris CIP 200, ProKlenz ONE)

- Zep Inc. (Zep FS CIP Cleaner, Zep Alkaline CIP)

- Zschimmer & Schwarz (ZETALON CIP, ZETALON Acid Cleaner)

CIP Chemicals Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 2.20 Billion |

| Market Size by 2032 | USD 4.76 Billion |

| CAGR | CAGR of 8.96% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product Type (Alkaline Cleaners, Acid Cleaners, Disinfectants/Sanitizers, Enzyme-Based Cleaners, Others) •By Process Type (Single-Use Cleaning, Recirculated Cleaning) •By Form (Liquid, Powder) •By End-Use Industry (Food & Beverage, Dairy Processing, Brewery & Distillery, Pharmaceutical & Biotechnology, Cosmetics & Personal Care, Others) |

| Key Drivers | • Rising Regulatory Standards Across the Food & Beverage and Pharmaceutical Industries Drive Demand for Cleaning in Place Chemicals. |

If You Need Any Customization on CIP Chemicals Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/6091

Technological Advancements & Innovations in CIP Chemicals

- Companies are developing enzyme-based CIP chemicals that enhance residue breakdown while reducing water and energy consumption.

- Manufacturers are introducing biodegradable and non-toxic alternatives to minimize environmental impact.

- Integration of AI and IoT in CIP systems improves efficiency and reduces manual intervention.

- Adoption of data-driven cleaning validation to enhance compliance and process efficiency.

- Development of closed-loop CIP systems to optimize water usage and reduce wastage.

By Product Type, Alkaline Cleaners Dominated the CIP Chemicals Market in 2023 with a 40.2% Market Share

The dominance is due to their superior efficiency in removing organic contaminants such as proteins and fats in food processing and pharmaceutical industries. These cleaners are widely used in dairy processing, where they effectively eliminate milk residues and prevent bacterial growth. Companies such as Diversey and Ecolab have developed advanced alkaline formulations with corrosion inhibitors to enhance equipment longevity. Additionally, increasing regulatory mandates on hygiene have accelerated the adoption of alkaline cleaners across industries.

By Form, Liquid CIP Chemicals Segment Dominated the CIP Chemicals Market in 2023 with a 72.4% Market Share

Liquid form CIP Chemicals dominated in 2023, owing to their ease of application, fast solubility, and effectiveness in automated CIP systems. The demand for liquid formulations is particularly high in industries requiring rapid and consistent cleaning, such as beverage manufacturing and pharmaceuticals. Major players like Solvay and BASF have introduced pH-balanced liquid CIP chemicals that improve cleaning efficiency while reducing water usage. The growing trend of sustainable formulations is further driving the adoption of liquid CIP chemicals.

By End-Use Industry, Food & Beverage Dominated the CIP Chemicals Market in 2023 with a 32.8 % Market Share

The food & beverage industry emerged as the leading end-use sector in 2023. Stringent hygiene regulations, coupled with rising production capacities in dairy, meat processing, and brewing industries, have fueled the demand for CIP chemicals. For instance, global dairy giants such as Danone and Nestlé have expanded their CIP infrastructure to ensure compliance with food safety standards. Additionally, the shift towards automation in beverage manufacturing has accelerated the adoption of CIP systems, further strengthening market growth.

Asia Pacific Region Dominated the CIP Chemicals Market In 2023, Holding A 40.7% Market Share.

Asia Pacific dominated the CIP Chemicals market in 2023, driven by rapid industrialization, expansion of the food & beverage sector, and stringent hygiene mandates in countries like China and India. The growing presence of multinational food processing companies and increased consumer awareness about food safety have contributed to market expansion. In 2023, the Indian Food Safety and Standards Authority (FSSAI) mandated stricter sanitation protocols, boosting the adoption of CIP chemicals. Furthermore, government initiatives promoting clean manufacturing in the pharmaceutical sector have also played a pivotal role in the market’s dominance in the region.

Europe Emerged as the Fastest Growing Region in CIP Chemicals Market with A Significant Growth Rate in The Forecast Period

Europe is the fastest-growing region in the CIP Chemicals market, with a significant CAGR of in 2023. The region’s growth is fueled by heightened awareness of food safety, sustainability initiatives, and increasing adoption of advanced CIP solutions in dairy and pharmaceutical sectors. The European Commission’s focus on reducing chemical waste in food processing has led to increased investments in eco-friendly CIP chemicals. Additionally, leading breweries and distilleries in Germany and Belgium are incorporating CIP technologies to improve efficiency while adhering to stringent hygiene regulations.

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. CIP Chemicals Market Segmentation, by Product Type

8. CIP Chemicals Market Segmentation, by Product Type

9. CIP Chemicals Market Segmentation, by Form

10. CIP Chemicals Market Segmentation, by End-Use Industry

11. Regional Analysis

12. Company Profiles

13. Use Cases and Best Practice

14. Conclusion

Buy Full Research Report on CIP Chemicals Market 2024-2032 @ https://www.snsinsider.com/checkout/6091

Buying Options

- 5 Reports Pack (USD 7500)

- 10 Report Pack (USD 12000)

- Vertical Subscription (150 Reports Pack Valid for 1 Year)

- Use this link to Purchase above packs @ https://www.snsinsider.com/subscription

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company’s aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

CONTACT: Jagney Dave - Vice President of Client Engagement Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. SingaporeOutlook.com takes no editorial responsibility for the same.

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. SingaporeOutlook.com takes no editorial responsibility for the same.