Climate Credit Analytics Market Size to Surpass USD 11.85 Billion by 2032, Owing to Regulatory Pressures and Rise in AI-Driven Carbon Monitoring Tools | SNS Insider

The climate credit analytics market is rapidly evolving as businesses, investors, and governments increasingly embrace environmental responsibility.

Pune, July 07, 2025 (GLOBE NEWSWIRE) — Climate Credit Analytics Market Size Analysis:

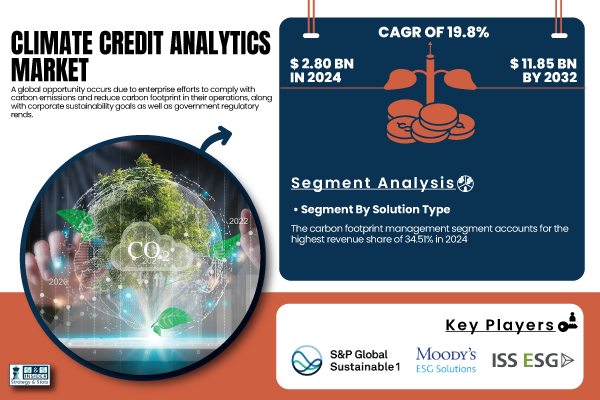

“The Climate Credit Analytics Market was USD 2.80 billion in 2024 and is expected to reach USD 11.85 billion by 2032, growing at a CAGR of 19.8% over the forecast period of 2025–2032.”

Climate Credit Analytics Surge as Enterprises Prioritize Carbon Reduction and ESG Compliance

The climate credit analytics market is exploding due to a rapid increase in enterprise initiatives to comply with environmental compliance and sustainability objectives. Firms are feeling the heat of reducing carbon footprints, maximising energy usage, and working within carbon credit trading programs. Climate credit analytics is a suite of tools that work together to monitor emissions, estimate the environmental footprint that results, and prescribe interventions such as carbon offsetting and investment in clean energy. The U.S. Climate Credit Analytics Market was valued at USD 0.82 billion in 2024 and is projected to reach USD 3.26 billion by 2032, growing at a CAGR of 18.84% during the forecast period of 2025–2032. The United States is ahead in climate credit analytics adoption through the intersection of policy imperatives, technological transformation, and corporate climate leadership. Pro-climate policies like the Inflation Reduction Act financially reward companies doing carbon accounting, investing in clean technologies, and aligning with global climate goals.

Get a Sample Report of Climate Credit Analytics Market@ https://www.snsinsider.com/sample-request/7085

Climate Credit Analytics Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 2.80 Billion |

| Market Size by 2032 | USD 11.85 Billion |

| CAGR | CAGR of 19.8% From 2025 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Key Segments | •By Solution Type (Carbon Footprint Management, Emission Tracking and Reporting, Renewable Energy Certificates (RECs) Analytics, Carbon Offsetting Analytics)

•By Industry (IT & Telecommunications, BFSI, Energy and Utilities, Manufacturing, Transportation, Others |

| Key Growth Drivers | Regulatory Pressures and Corporate Sustainability Initiatives Propel Climate Credit Analytics Adoption |

Do you have any specific queries or need any customization research on Climate Credit Analytics Market, Make an Enquiry Now@ https://www.snsinsider.com/enquiry/7085

By Solution Type

The carbon footprint management is currently dominating, leading the climate credit analytics market with a revenue market share of 34.51% in 2024. This expansion is driven by surging corporate net-zero pledges and increased environmental regulations. Many others are also getting the job done because companies are increasingly looking to them to track emissions for sustainability reporting, with platforms like IBM’s Environmental Intelligence Suite, and the carbon offsetting analytics market is expected to witness the fastest CAGR of 21.12% CAGR throughout the forecast period. The rush is fueled by an increasing appetite for top-grade, verifiable carbon credits. Companies like Shell and Delta Air Lines now employ AI and satellite data, via platforms such as Pachama and Sylvera, to verify offset projects and make sure they are transparent.

By Industry

The BFSI segment is anticipated to be the fastest-growing market with a CAGR growth rate of 21.68% over the forecast period. Financial Markets Climate-related financial risks are coming onto the regulatory radar, and financial institutions are integrating into their risk models, investment decisions, and stress tests the results of climate credit analytics. Firms like BlackRock and HSBC are able not just to measure carbon exposure at the portfolio level, for example, but also create sustainable finance products by employing ESG frameworks and analytics platforms. Growing investor interest in sustainable investment opportunities, as well as regulatory attention to financial information, are also important triggers to the growth of this market.

Buy an Enterprise-User PDF of Climate Credit Analytics Market Analysis & Outlook 2024-2032@ https://www.snsinsider.com/checkout/7085

North America Leads, Asia Pacific Rises as Fastest-Growing Market

North America has the largest share, 41.18% in the 2024 climate credit analytics market due to a stringent government regulatory framework, technological innovation, and the U.S. Inflation Reduction Act. Already, the region is an early adopter of AI and blockchain for emissions monitoring and has a mature ESG ecosystem. Europe is a close second, having successfully implemented climate policies, such as the EU ETS or the CSRD. Germany is a leader in decarbonization and the use of renewable energy. The APAC region is anticipated to register the highest CAGR of 20.54%, due to industrial growth, changing regulations, and the unveiling of national carbon markets, especially in China and South Korea. The Middle East & Africa and Latin America, however, are potential regions. Countries such as the UAE and Brazil are now making climate policy part of their national development strategy by investing in green finance and analytic platforms to accomplish long-term sustainability goals.

Recent Developments

- February 2025: Bloomberg debuted the MARS Climate, which is part of its MARS suite and helps investors assess financial risk stemming from climate change and align portfolios with NGFS climate scenarios. And it’s reinforced by BloombergNEF’s TRACT engine, which carries best-in-class climate modeling to institutional investors.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company’s aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

CONTACT: Contact Us: Jagney Dave - Vice President of Client Engagement Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. SingaporeOutlook.com takes no editorial responsibility for the same.

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. SingaporeOutlook.com takes no editorial responsibility for the same.