Copper Scrap Market Size to be Valued at USD 63.52 Billion by 2032 Owing to the Technological Innovations in Recycling Processes Globally | SNS Insider

The Copper Scrap Market is seeing strong growth due to the high demand for verified, reusable, environmentally friendly, promoted sources. Technological innovations in recycling processes, coupled with strict environmental regulations, are driving efficient recovery and recycling of copper.

Austin, Sept. 16, 2025 (GLOBE NEWSWIRE) — Copper Scrap Market Size Analysis

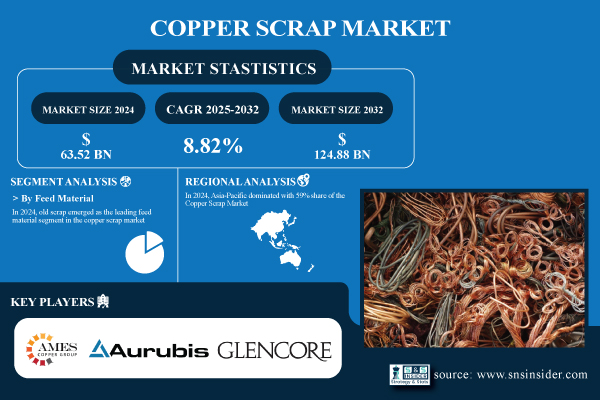

As per SNS Insider Research, The Copper Scrap Market size was valued at USD 63.52 Billion in 2024 and is projected to reach USD 124.88 Billion by 2032, growing at a CAGR of 8.82% during 2025–2032.

Growing Use of Copper Scrap Recycling for Sustainability and Energy Efficiency Propel Market Expansion

Since the copper scrap or recycling industry has a far smaller environmental impact than primary copper manufacturing, sustainability and energy efficiency are key factors in the global copper scrap market. As a result, using copper scrap lowers reliance on mining, a resource-intensive and environmentally harmful operation that can result in up to 85% reductions in energy demand and CO2 emissions. Copper is essential for achieving the goals of the circular economy, as evidenced by the fact that about 30% of the world’s copper demands are met by recycled copper.

Get Sample Report of Copper Scrap Market @ https://www.snsinsider.com/sample-request/8497

Major Players Analysis Listed in this Report are

- Ames Copper Group

- Aurubis AG

- CMC

- Glencore

- Global Metals & Iron Inc.

- JAIN RESOURCE RECYCLING PVT LTD.

- KGHM METRACO S.A.

- OmniSource, LLC.

- Pascha GmbH

- Perniagaan Logam Panchavarnam Sdn Bhd

- S.I.C. Recycling, Inc.

- Boliden

- Sims Limited (Sims Metal)

- Umicore

- Schnitzer Steel / Radius Recycling

- Metalico, Inc.

- Cyclic Materials

- Kuusakoski Oy

- European Metal Recycling (EMR)

- SA Recycling LLC

Segment Analysis

By Type, By Feed Material, Old Scrap Segment Dominated the Market in 2024

In 2024, old scrap emerged as the leading feed material segment in the copper scrap market due to its steady availability from recycling and reprocessing activities scrap, specifically from decommissioned infrastructure. New scrap segment is expected to grow with the fastest CAGR during the forecast period owing to the increasing adoption of sustainable manufacturing practices and circular economy initiatives have driven higher demand for new scrap, marking its rising significance in supporting greener and efficient supply chains.

By Grade, #2 Copper Scrap Segment Dominated the Market

The copper scrap market in 2024 was dominated by #2 copper scrap, primarily due to its widespread availability and cost-effectiveness for multiple industrial applications.

By Application, Brass Mills Accounted for the Largest Market Share in 2024

In 2024, brass mills accounted for the dominant application segment in the copper scrap market, fueled by strong demand for brass products across industries such as construction, automotive, and consumer goods.

By End-Use, the Market was Dominated by Electrical and Electronics Segment in 2024

The electrical and electronics sector dominated the copper scrap market in 2024 and is expected to be the fastest growing segment in the market. The growth is driven by copper’s unmatched conductivity, durability, and recyclability, which are essential for power transmission, electronic devices, and smart infrastructure.

Need Any Customization Research on Copper Scrap Market, Enquire Now: https://www.snsinsider.com/enquiry/8497

By Region, in 2024, Asia Pacific Dominated the Market with Around 59% Share; North America is Expected to Maintain Dominant Position in the Market

In 2024, Asia Pacific dominated with 59% share of the Copper Scrap Market, making it the leading region globally. The region’s growth is driven by the government-backed initiatives promoting recycling energy efficiency and sustainable production. In 2024, North America demonstrated a strong position in the copper scrap market owing to advanced recycling infrastructure and widespread copper usage across multiple sectors.

Exclusive Sections of the Report (The USPs) – Check Section 5

- ENVIRONMENTAL COMPLIANCE METRICS – helps you understand the regulatory pressure and sustainability benchmarks across key markets. Tightening environmental regulations in the EU, China, and North America are pushing recyclers toward cleaner processing standards. Over 70% of copper scrap processing facilities are now subject to stricter emission and waste management norms, making sustainability a critical compliance driver in the market.

- TECHNOLOGICAL ADOPTION RATE – helps you uncover opportunities for investment or innovation in underpenetrated areas. Digital sorting, AI-driven scrap classification, and automated material recovery systems are gaining momentum, with digital adoption rates crossing 40% in Tier-1 facilities. This opens up investment opportunities in emerging regions and mid-scale plants still reliant on manual processes.

- SUPPLY CHAIN DISRUPTION INDEX – helps you identify regions or suppliers at higher risk due to geopolitical or logistical factors. Supply chain risk remains elevated due to heavy dependence on Asia-Pacific and Latin American suppliers, where political instability and export curbs have disrupted material flow. The report highlights logistics cost inflation of 18% YoY, affecting downstream profitability.

- CAPACITY UTILIZATION RATES – helps you identify whether the industry is facing overcapacity or undersupply, which impacts pricing and investment decisions. Copper scrap processing facilities in North America and Europe are running at 84–89% utilization, while Asian facilities face underutilization below 65% due to inconsistent feedstock availability. This mismatch is influencing global pricing trends and cross-border material flows.

- COMPETITIVE LANDSCAPE – helps you gauge the competitive strength of key players in the market backed by an analysis of their growth projections, market reach, product/service offerings and recent developments. Key players are engaging in aggressive regional expansions and joint ventures, especially in Southeast Asia and Africa. The top 5 players account for 48% of market share, with M&A activity rising to secure raw material access and forward integration into refined copper products.

Recent Developments:

- In December 2024, Glencore partnered with Canadian recycler Cyclic Materials to supply over 10,000 metric tons of recycled copper. The copper will be processed at Glencore’s Horne Smelter and Copper Refinery in Quebec into copper cathodes for new products. This collaboration supports the growing demand for copper in electric vehicles, renewable energy, and AI data centers while promoting sustainable recycling and resource circularity.

- In April 2025, Aurubis AG, Europe’s largest copper producer, announced an $800 million investment to build a state-of-the-art copper recycling facility in Richmond, Georgia. Set to begin operations in 2025 after four years of construction, the plant will be North America’s first large-scale copper recycling site, processing 180,000 metric tons of scrap annually to produce 70,000 tons of refined copper.

Get the Full Report of Copper Scrap Market Report (Single-User License): https://www.snsinsider.com/checkout/8497

Copper Scrap Market Report Scope

| Report Attributes | Details |

| Market Size in 2024 | USD 63.52 Billion |

| Market Size by 2032 | USD 124.88 Billion |

| CAGR | CAGR of 8.82% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Feed Material (Old Scrap, New Scrap)

• By Grade (Bare Bright, #1 Copper Scrap, #2 Copper Scrap, Other Grades) • By Application (Wire Rod Mills, Brass Mills, Ingot Makers, Other Applications) • By End-use (Building & Construction, Electrical & Electronics, Industrial Machinery & Equipment, Transport Equipment, Consumer & General Products) |

| Regional Analysis | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company’s aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

CONTACT: Contact Us: Jagney Dave - Vice President of Client Engagement Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK) Email: info@snsinsider.com

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. SingaporeOutlook.com takes no editorial responsibility for the same.

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. SingaporeOutlook.com takes no editorial responsibility for the same.