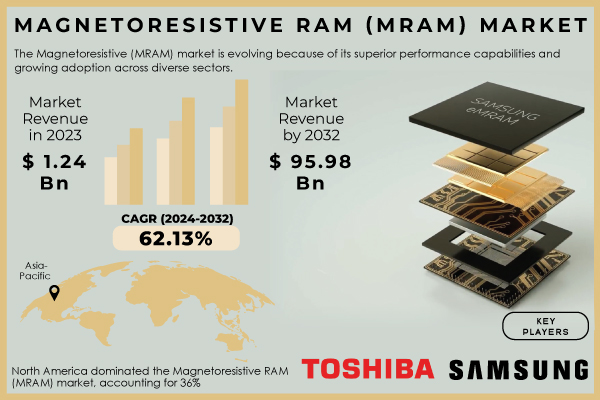

Magnetoresistive RAM (MRAM) Market is Expected to Reach USD 95.98 Billion by 2032, Fueled by Funding in Advanced MRAM Technology that Utilizes Electron Spin for Storing Information

The increasing need for advanced memory solutions is driven by the growth of electronic devices, wearable technology, and emerging technologies such as IoT and robotics.

Pune, Sept. 09, 2024 (GLOBE NEWSWIRE) — The SNS Insider report indicates that, “The Magnetoresistive RAM (MRAM) Market Size was valued at USD 1.24 billion in 2023 and is expected to reach USD 95.98 billion by 2032 and grow at a CAGR of 62.13% over the forecast period 2024-2032.”

Magnetoresistive RAM (MRAM) Market Poised for Rapid Expansion with eMRAM Innovations

The MRAM market is set to experience substantial growth. The growth is being propelled by the rising need for advanced, power-saving non-volatile memory solutions. Significant progress in eMRAM technology, with 8nm development nearing completion and continuous enhancements, is establishing a new benchmark in the field. eMRAM outperforms DRAM in terms of speed and does not need data refreshing. It is a great option for tasks that need both resilience and fast retrieval. Market projections suggest that the widespread adoption of mass production below 40nm will occur in various processes. There are expectations that eMRAM will fulfill the automotive industry’s need for quality requirements and will be a suitable choice for the growing use of big data and AI technologies.

Download PDF Sample of Magneto Resistive RAM (MRAM) Market @ https://www.snsinsider.com/sample-request/2315

Key Players

- Toshiba Corporation

- Everspin Technologies

- Samsung Electronics

- NVE Corporation

- Avalanche Technology

- Honeywell International

- Numem

- IBM Corporation

- Infineon Technologies AG

- Crocus Nano Electronics LLC

Magneto Resistive RAM (MRAM) Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 1.24 Billion |

| Market Size by 2032 | USD 95.98 Billion |

| CAGR | CAGR of 62.13% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Spin-Transfer Torque MRAM (STT-MRAM), Toggle MRAM • By Offering( Stand-Alone,Embedded) • By Application (Enterprise Storage, Automotive, Aerospace & Defense, Consumer Electronics, Robotics And Others) |

| Key Drivers | • Advanced memory solutions are fueling innovation in the automotive industry. • Magnetoresistive (MRAM) is essential for the progression of autonomous driving and enhancing vehicle safety. |

If You Need Any Customization on Magneto Resistive RAM (MRAM) Market Report, Enquire Now @ https://www.snsinsider.com/enquiry/2315

Magnetoresistive RAM (MRAM) improves hardware security by utilizing advanced PUF circuits.

Magnetoresistive RAM (MRAM) is one of the hardware security improvements by introducing PUF circuits using MTJ cells to enhance protection. Compared to the conventional Arbiter PUFs, PUF circuits based on MRAM meet the SAC and offer improved protection from machine learning attacks. In the simulations, the prediction accuracies of the multilayer perceptron, linear regression, and support vector machine attacks were low, with approximately 53.61% in the case of a two-array circuit and 49.87% in a four-array circuit. The accuracies of the deep learning attacks were also low, at approximately 50.31%. It is one of the reasons for MRAM’s increased demand, which is due to the increasing demand for secure data storage. Thus, MRAM is one of the developments of non-volatile, safe memory.

STT-MRAM’s Dominance and Expansion in Aerospace Impacting Magnetoresistive RAM (MRAM) Market in 2023.

By 2023, Spin-Transfer Torque MRAM (STT-MRAM) emerges as the leading technology in the MRAM market, securing 68% of the total revenue. The exceptional performance of this technology is achieved by utilizing spin-transfer torque for fast writing and improved longevity. STT-MRAM surpasses conventional memory choices like DRAM and NAND flash, making it perfect for demanding uses such as automotive ADAS and infotainment systems. Its lack of volatility and minimal power usage are in line with the increasing need for effective memory solutions brought on by advancements in IoT and edge computing.

In 2023, the aerospace and defense sector led the MRAM market with a 41% revenue share, driven by MRAM’s unmatched reliability, durability, and performance in demanding environments. MRAM’s non-volatility, high endurance, and radiation resistance make it ideal for aerospace and military applications. Advances in STT-MRAM have enhanced speed and durability, crucial for defense systems and satellite communications. Additionally, improvements in MRAM technology, such as better magnetic tunnel junctions, support the development of compact, efficient memory solutions for avionics and space exploration.

Major factors stimulating growth in the Magnetoresistive RAM (MRAM) market are North America and Asia Pacific regions.

In 2023, North America led the MRAM market with 36% of global revenue, driven by its advanced technology infrastructure and substantial investment in semiconductor research. Major U.S. companies and research institutions are at the forefront of developing high-performance STT-MRAM and other MRAM variants, focusing on enhancing speed, reliability, and scalability. Government support, such as the CHIPS Act, and key players like IBM and Intel underscore North America’s pivotal role in advancing MRAM technology.

In 2023, Asia Pacific, with a 26% market share, was the second fastest-growing MRAM region, fueled by its expanding semiconductor sector and R&D investments. China, Japan, and South Korea drive progress, with major players like SMIC, Sony, Toshiba, Samsung, and SK Hynix advancing MRAM technology and applications.

Buy Full Research Report on Magneto Resistive RAM (MRAM) Market 2024-2032 @ https://www.snsinsider.com/checkout/2315

Latest Progress in Magnetoresistive RAM (MRAM) Technology and Improvements in Manufacturing

- December 2022: Toshiba Electronic Devices and Storage Corporation announced plans to build a new power semiconductor production facility at Himeji Operations in Hyogo Prefecture, Japan, with construction starting in June 2024 and production expected by spring 2025.

- September 2022: Avalanche Technology and United Microelectronics Corporation (UMC) unveiled high-reliability Persistent SRAM (P-SRAM) memory using UMC’s 22nm process and Avalanche’s latest STT-MRAM technology, offering improved density, reliability, endurance, and power efficiency.

- July 2021: IIT Delhi and National University of Singapore researchers advanced integration density in SOT-MRAMs, which show better reliability and writing speed than STT-MRAMs, though they still lag in integration density.

Key Takeaways for Magnetoresistive RAM (MRAM) Market

- Re-Subsequent to analyzing the market terrain one can become more adept at knowing upcoming opportunities and obstacles,

- The report offers a forecast of the market for future expansion and management of resources.

- Knowing the Pros and Cons of MRAM — it enables to verify if this technology is fit to purpose.

- Keep up to date on MRAMs state of play for smarter product development, investments, and partnerships.

Table of Contents – Major Key Points

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Wafer Production Volumes, by Region (2023)

5.2 Chip Design Trends (Historic and Future)

5.3 Fab Capacity Utilization (2023)

5.4 Supply Chain Metrics

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Magnetoresistive RAM (MRAM) Market Segmentation, by Type

7.1 Chapter Overview

7.2 Spin-Transfer Torque MRAM (STT-MRAM)

7.3 Toggle MRAM

8. Magnetoresistive RAM (MRAM) Market Segmentation, by Offering

8.1 Chapter Overview

8.2 Stand-alone

8.3 Embedded

9. Magnetoresistive RAM (MRAM) Market Segmentation, by Application

9.1 Chapter Overview

9.2 Enterprise Storage

9.3 Automotive

9.4 Aerospace & Defense

9.5 Consumer Electronics

9.6 Robotics

9.7 Others

10. Regional Analysis

11. Company Profiles

12. Use Cases and Best Practices

13. Conclusion

Access Complete Report Description of Magneto Resistive RAM (MRAM) Market Report 2024-2032 @ https://www.snsinsider.com/reports/magneto-resistive-ram-mram-market-2315

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company’s aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

CONTACT: Contact Us: Akash Anand – Head of Business Development & Strategy info@snsinsider.com Phone: +1-415-230-0044 (US)

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. SingaporeOutlook.com takes no editorial responsibility for the same.

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. SingaporeOutlook.com takes no editorial responsibility for the same.