Microinsurance Market Size to Grow USD 138.29 Billion by 2032, Driven by Demand for Affordable Coverage | Report by SNS Insider

The U.S. Microinsurance Market was valued at USD 16.46 billion in 2024 and is anticipated to reach USD 27.30 billion by 2032, growing at a CAGR of 6.53% from 2025 to 2032.

Austin, July 22, 2025 (GLOBE NEWSWIRE) — Microinsurance Market Size & Growth Insights:

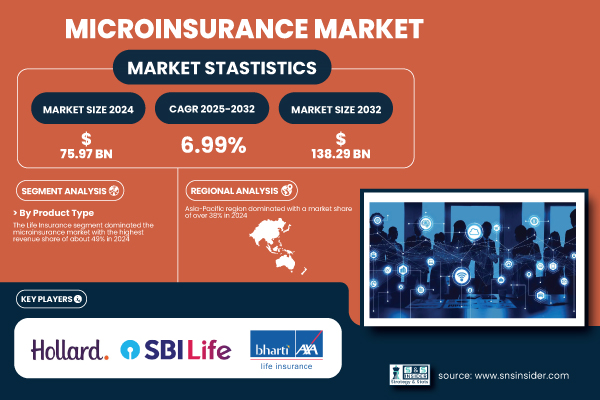

According to the SNS Insider Report, “The Microinsurance Market was valued at USD 75.97 billion in 2024 and is projected to reach USD 138.29 billion by 2032, expanding at a compound annual growth rate (CAGR) of 6.99% between 2025 and 2032.”

This expansion is fueled by increasing appetite for easy and affordable access to insurance by low income populations, especially in developing countries. Growing government support, digitization of policy delivery, and participation of microfinance institutions, NGOs etc. are further driving market penetration. And increasing awareness on financial protection, and desire to mitigate risk in marginalised communities is driving the demand for micro insurance products.

Get a Sample Report of Microinsurance Market @ https://www.snsinsider.com/sample-request/6951

Leading Market Players with their Product Listed in this Report are:

- Hollard Insurance Company

- afpgen.com.ph

- American International Group Inc.

- Bharti AXA Life Insurance Company Ltd.

- SBI Life Insurance Company Ltd.

- ICICI Prudential Life Insurance Co. Ltd.

- Banco do Nordeste Brasil S.A.

- Climbs

- Allianz SE

- Axa Group

- BRAC

- MetLife Foundation

- MicroEnsure

- SKS Microfinance

- Swiss Re

- Telenor Microfinance Bank

- Zurich Insurance Group

- Bajaj Allianz Life Insurance Co. Ltd

Microinsurance Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 75.97 Billion |

| Market Size by 2032 | USD 138.29 Billion |

| CAGR | CAGR of 6.99% From 2024 to 2032 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Provider (Microinsurance – Commercially Viable, Microinsurance Through Aid/Government Support) • By Model Type (Partner Agent Model, Full-Service Model, Provider Driven Model, Others) • By Product Type (Life Insurance, Health Insurance, Property Insurance, Others) • By Distribution Channel (Direct Sales, Financial Institutions, Digital Channels, Others) • By End Use (Business, Personal) |

Purchase Single User PDF of Microinsurance Market Report (20% Discount) @ https://www.snsinsider.com/checkout/6951

Key Industry Segmentation

By Model Type, Full-Service Model Segment Set to Witness Fastest Growth at 8.72% CAGR from 2025 to 2032

The Full-Service Model segment is projected to expand at the fastest CAGR of 8.72% between 2025 and 2032, driven by its comprehensive approach that combines underwriting, claims management, and customer service. By removing operational silos, this model enhances efficiency and customer satisfaction. Its ability to quickly adapt to customer needs and offer tailored solutions, coupled with growing digital integration, makes it highly scalable and increasingly preferred in the microinsurance market.

By Product Type, Life Insurance Segment Dominated Microinsurance Market with 49% Revenue Share in 2024

In 2024, the life insurance segment held the largest revenue share in the microinsurance market at approximately 49%, as it remains a fundamental tool for financial security among low-income earners. Heightened concerns over the economic consequences of losing a primary wage earner fueled demand. Additionally, government-backed schemes and NGO-led initiatives promoted basic life insurance, significantly boosting adoption and contributing to strong revenue growth across this segment.

By Distribution Channel, Financial Institutions Segment Captured 33% Revenue Share in 2024

In 2024, the financial institutions segment led the microinsurance market with a 33% revenue share, leveraging strong ties with low-income communities through banks, cooperatives, and microfinance institutions. These entities utilized trusted relationships and wide-reaching distribution channels to efficiently deliver microinsurance. By bundling policies with credit products, they made coverage more accessible and affordable, resulting in high adoption rates and large-volume sales that solidified their market dominance.

By End Use, Business Segment Leads Microinsurance Market with 57% Share in 2024

In 2024, the business segment accounted for approximately 57% of the total microinsurance market share, driven by the growing need for customized insurance products among small and medium-sized enterprises (SMEs). Companies increasingly turned to microinsurance to protect themselves from financial shocks, workplace accidents, and sector-specific health risks. Affordable group coverage options also appealed to businesses operating with tight budgets, significantly boosting adoption across this segment.

Do you have any specific queries or need any customized research on Microinsurance Market? Submit your inquiry here @ https://www.snsinsider.com/enquiry/6951

Asia Pacific Led the Microinsurance Market, North America to Register Fastest CAGR

Asia Pacific dominated the microinsurance market in 2024, accounting for around 38% of revenue. This leadership stems from a vast low-income population in nations like India, China, and Southeast Asia. Strong mobile penetration, government-backed financial inclusion programs, and increasing demand for affordable risk protection solutions contributed significantly to the region’s market dominance.

North America is projected to grow at the fastest CAGR of 8.67% from 2025 to 2032, driven by heightened awareness of microinsurance products and a growing need for affordable coverage among underserved populations. Technological advancements, partnerships with fintechs and mobile operators, and a strong push for financial inclusion are enabling wider access to cost-effective insurance solutions in the region.

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. Microinsurance Market, by Component

8. Microinsurance Market, by Service Type

9. Microinsurance Market, by Service Model

10. Microinsurance Market, by Organization Size

11. Microinsurance Market, by Vertical

12. Regional Analysis

13. Company Profiles

14. Use Cases and Best Practices

15. Conclusion

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company’s aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

CONTACT: Contact Us: Jagney Dave - Vice President of Client Engagement Phone: +1-315 636 4242 | +44- 20 3290 5010 (UK)

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. SingaporeOutlook.com takes no editorial responsibility for the same.

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. SingaporeOutlook.com takes no editorial responsibility for the same.