Polypropylene Catalyst Market Projected to Reach USD 8.07 Billion by 2032 | Rising Demand for Polypropylene Driving Market Growth

The polypropylene catalyst market is experiencing substantial growth, driven by the increasing demand for polypropylene across diverse industrial sectors.

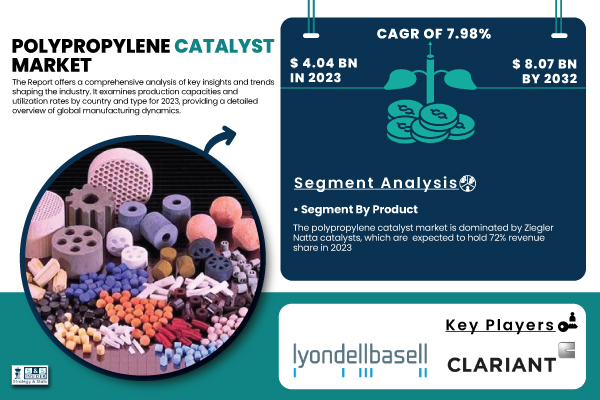

Austin, April 04, 2025 (GLOBE NEWSWIRE) — The polypropylene catalyst market is projected to reach a valuation of USD 8.07 billion by 2032, expanding at a compound annual growth rate (CAGR) of 7.98% from 2024 to 2032.

Polypropylene catalysts are of utmost importance for polymerization because they affect molecular weight, stereoregularity, and polymer properties. Increasing demand for polypropylene in packaging, automotive, construction, and medical applications is driving the need for better catalyst technologies. Moreover, the development of catalyst formulations and improvements amongst metallocene and Ziegler-Natta catalysts is enhancing polymer productivity and quality, thus driving the market growth.

Strong demand for polypropylene in end-use industries such as automotive components, consumer goods, and industrial applications is boosting the growth of the polypropylene catalyst market in the United States. In 2023, the country held the largest market share attributed to rising investments in the research and development of polymers. Promising regulations across the globe for sustainable polymer production by the U.S. Environmental Protection Agency (EPA) and further adoption of lightweight high-performance plastics in the automotive sector are some of the factors parsing the market growth. Moreover, the establishment of petrochemical refineries and production facilities by industry giants such as LyondellBasell and ExxonMobil are reaffirming the growth of the polypropylene catalyst market in the U.S.

Download PDF Sample of Polypropylene Catalyst Market @ https://www.snsinsider.com/sample-request/6280

Key Players:

- LyondellBasell Industries (Avant ZN, Avant Metallocene)

- W. R. Grace & Co. (Polytron 300, Polytron 400)

- Clariant AG (PolyMax 600, PolyMax 700)

- China Petrochemical Corporation (SinoPP 100, SinoPP 200)

- Mitsui Chemicals, Inc. (Mitsui CX, Mitsui AX)

- BASF SE (Lupotech T, Lupotech G)

- Evonik Industries AG (VESTOPLAST 206, VESTOPLAST 408)

- Univation Technologies, LLC (XCAT Metallocene, Prodigy Bimodal)

- Sumitomo Chemical Co., Ltd. (Sumitomo PP 1100, Sumitomo PP 2200)

- INEOS Group Holdings S.A. (Innovene PP, Innovene S)

- ExxonMobil Chemical (Achieve Advanced PP, Vistamaxx)

- Japan Polypropylene Corporation (Novolen PP, JPP Catalyst)

- Reliance Industries Limited (Relene PP, RIL PP 100)

- Borealis AG (Borstar PP, Borceed PP)

- Wacker Chemie AG (VINNAPAS PP, WACKER PP 300)

- Albemarle Corporation (Albemarle PP Ziegler, Albemarle PP Metallocene)

- UOP LLC (UOP PPQ, UOP PolyMax)

- Shell Chemicals (Shell PP Catalyst, Shell Metallocene PP)

- SABIC (SABIC PP 500, SABIC PP 700)

- Axens SA (Axens PP Catalyst, Axens Metallocene PP)

Polypropylene Catalyst Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 4.04 Billion |

| Market Size by 2032 | USD 8.07 Billion |

| CAGR | CAGR of 7.98% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Ziegler-Natta Catalyst, Metallocene Catalyst, Others) • By Manufacturing Process (Bulk Phase, Gas Phase, Others) • By Application, (Injection Molding, Blow Molding, Film, Fiber, Others) |

| Key Drivers | • Increasing demand for high-performance polypropylene in automotive and packaging industries drives the polypropylene catalyst market growth. |

If You Need Any Customization on Polypropylene Catalyst Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/6280

Market Segmentation

By Type

Ziegler-Natta catalysts dominated the polypropylene catalyst market in 2023, holding approximately 72% of the total market share. These catalysts are widely utilized in the bulk production of polypropylene due to their cost-effectiveness and ability to produce high isotacticity polymers, which enhance material strength and durability. Ziegler-Natta catalysts remain the preferred choice in large-scale polypropylene manufacturing, especially in Asia Pacific and North America.

Metallocene catalysts are gaining traction due to their superior control over polymer microstructure. This results in high-performance polypropylene grades with enhanced clarity, toughness, and processing properties. The increasing demand for specialty polypropylene applications in packaging, medical devices, and automotive components is driving the adoption of metallocene catalysts.

By Manufacturing Process

Gas-phase polymerization accounted for the largest share of the polypropylene catalyst market in 2023, comprising approximately 48% of the total market. The dominance of this process is attributed to its operational efficiency, low energy consumption, and ability to produce polypropylene with uniform properties. Major polypropylene producers are adopting gas-phase polymerization technology to optimize production costs and enhance yield efficiency.

Bulk-phase polymerization is another widely used process, particularly in the production of high-purity polypropylene grades for specialized applications. This method is favored for its reduced solvent consumption and ability to produce high-impact polypropylene copolymers with superior mechanical properties.

By End-Use Industry

Injection molding occupies a 28% market share due to its wide application in automotive, packaging, and consumer goods. In the field of high-performance polypropylene, LyondellBasell and Mitsui Chemicals suggest that catalysts new to their respective processes provide superior mechanical properties and long-term durability. Tough, high flow polypropylene grades by LyondellBasell (Houston, TX) deliver lightweight and high impact resistant components, which are showcased in LyondellBasell’s Hostalen PP Injection Molding series, a member of a family of Hostalen PP grades used in automotive interiors, food packaging and other applications. Catalyst innovation delivering low volumetric performance polypropylene components to a mix of industries brings the expressive growth from the segment into the spotlight.

Regional Analysis

In 2023, the Asia Pacific accounted for approximately 42% of the market share. This is due to the fast industrialization with a high demand for downstream products from polypropylene and continuous investment in petrochemical facilities. Increased production capacities by leading polypropylene producers like Sinopec, Mitsui Chemicals, and LyondellBasell will also facilitate market growth in the region, owing to rising demand from end-use industries from automotive and packaging to construction. Additionally, the expanding manufacturing sector and growing level of disposable incomes in China and India are expected to create demand for polypropylene in sales in upcoming years. The availability of low-cost labor and raw materials and efficient government initiatives in the region to support the petrochemical industry further add to the dominance in the region. With Japan and South Korea taking the lead in the innovation and manufacture of polypropylene catalysts, catalysed processes, along with the development of catalyst technology, continue to stimulate the market in the region, for the Asia Pacific continues to be at the forefront of countries with innovation in manufacturing polypropylene catalysts.

Recent Developments

- In 2023, Clariant AG introduced a new range of polypropylene catalysts designed to enhance polymerization efficiency and reduce process emissions, aligning with sustainability goals.

- In 2023, W. R. Grace & Co. expanded its polypropylene catalyst production capacity in North America to cater to the rising demand from polymer manufacturers.

- In 2023, LyondellBasell announced a strategic collaboration with a leading research institute to develop next-generation metallocene catalysts for high-performance polypropylene applications.

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. Polypropylene Catalyst Market Segmentation, by Product

8. Polypropylene Catalyst Market Segmentation, By Manufacturing Process

9. Polypropylene Catalyst Market Segmentation, By Application

10. Regional Analysis

11. Company Profiles

12. Use Cases and Best Practices

13. Conclusion

Buy Full Research Report on Polypropylene Catalyst Market 2024-2032 @ https://www.snsinsider.com/checkout/6280

Buying Options

- 5 Reports Pack (USD 7500)

- 10 Report Pack (USD 12000)

- Vertical Subscription (150 Reports Pack Valid for 1 Year)

- Use this link to Purchase above packs @ https://www.snsinsider.com/subscription

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company’s aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

CONTACT: Jagney Dave - Vice President of Client Engagement Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. SingaporeOutlook.com takes no editorial responsibility for the same.

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. SingaporeOutlook.com takes no editorial responsibility for the same.