Universal Flash Storage Market Set to Reach USD 32.96 Billion by 2032, driven by demand for faster, low-power data storage | SNS Insider

Universal Flash Storage Market growth is driven by generative AI-driven smartphone demand, 5G and IoT expansion, high-speed multilane/3DNAND adoption, and automotive infotainment needs.

Austin, July 08, 2025 (GLOBE NEWSWIRE) — Universal Flash Storage Market Size & Growth Insights:

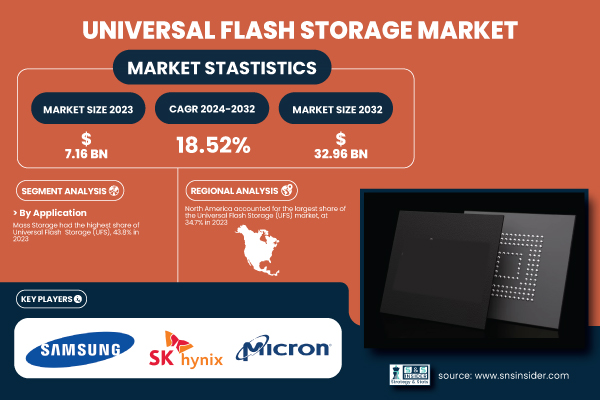

According to the SNS Insider Report, “The Universal Flash Storage Market Size was valued at USD 7.16 Billion in 2023 and is expected to reach USD 32.96 Billion by 2032 and grow at a CAGR of 18.52% over the forecast period 2024-2032.”

Rising demand for advanced data storage in smartphones, automotive systems, and AI-powered devices.

The Universal Flash Storage (UFS) market is leading the expansion of consumer electronics driven by its ability to access data in real time at high speeds. The superior performance of eMMC for mobile devices, Tablets, Laptops, and other consumer electronics has led to the increasing popularity of UFS as it outshines traditional technology when it comes to the read/write speeds, Latency, and concurrency And the transition to 5G, the rapid rise of edge computing and emergence of AI processes will only increase the need for more cost-effective storage that provides greater performance. The U.S. Universal Flash Storage Market was valued USD 1.94 Billion in 2023 and witness a growth at a CAGR of 18.33% during the forecast period.

Get a Sample Report of Universal Flash Storage Market @ https://www.snsinsider.com/sample-request/6648

Leading Market Players with their Product Listed in this Report are:

- Samsung Electronics (UFS 4.0 Storage)

- SK Hynix (UFS 3.1 NAND Flash)

- Kioxia Corporation (UFS Embedded Memory)

- Western Digital (iNAND MC EU551 UFS)

- Micron Technology (UFS 3.1 Mobile Memory)

- Toshiba Memory (UFS 2.1 Embedded Storage)

- Silicon Motion (UFS Controller SM2750)

- Phison Electronics (UFS Controller PS8311)

- Synopsys (DesignWare UFS IP)

- Cadence Design Systems (UFS Host Controller IP)

- Arasan Chip Systems (UFS 3.1 PHY + Controller IP)

- Marvell Technology (UFS Storage Controller)

- Rambus (UFS PHY IP)

- UNISOC (UFS 3.1 Flash Interface)

- MediaTek (Dimensity SoC with UFS 3.1 Support).

Universal Flash Storage Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 7.16 Billion |

| Market Size by 2032 | USD 32.96 Billion |

| CAGR | CAGR of 18.52% From 2024 to 2032 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Mass Storage, Boot Storage, XiP Flash, External Card)

• By Capacity (32 GB, 64 GB, 128 GB, 256 GB, 512 GB) • By Configuration (Embedded, Removable) • By End Use (Automotive Electronics, Digital Cameras, Gaming Consoles, High-Resolution Displays, Laptops, Smartphones, Others) |

Purchase Single User PDF of Universal Flash Storage Market Report (20% Discount) @ https://www.snsinsider.com/checkout/6648

In addition, UFS adoption is increasing also in the automotive segment for applications such as ADAS, digital instrument clusters and infotainment systems where real-time data processing is critical. Its growing importance in enabling next-gen apps and seamless user experiences will be further accentuated as original equipment manufacturers (OEMs) increasingly adopt UFS in mid to high-end devices.

Key Industry Segmentation

By Application

In 2023, Mass Storage accounted for the largest share (43.8%) of the Universal Flash Storage (UFS) market, driven by its widespread use in smartphones, tablets, and laptops, where fast data access, multitasking, and high-capacity storage are essential.

XiP (Execute-in-Place) Flash is anticipated to have the highest CAGR between 2024 and 2032, primarily due to its increasing adoption in applications such as automotive electronics, IoT, and embedded systems requiring real-time performance features like fast boot-up, low-latency and efficient use in small form factor devices.

By Capacity

In 2023, the 128 GB segment led the UFS market with a 29.6% share, it offers the sweet spot between cost, performance, and storage for mid-range to premium devices. It brings this popularity because it manages apps, media, and updates altogether flexibly.

The 256 GB segment is projected to grow fastest from 2024 to 2032, rapid growth in storage demand for 5G mobile phones, gaming, AR/VR, and high-resolution content-related applications will be the drivers for the 256 GB segment.

By Configuration

In 2023, Embedded configuration dominated the Universal Flash Storage (UFS) market with a 77.5% share, due to the significant demand of compact, high-speed, and low-power storage for smartphones, tablets, laptops, and automotive infotainment systems. Now here comes embedded UFS to turn things right, for it offers higher performance speed along with multitasking without compromising the user experience.

The Removable UFS segment is projected to witness the highest CAGR from 2024 to 2032, owing to increasing demand for portable, high-speed storage in consumer electronics (such as drones and cameras) and industrial applications (such as testing, medical imaging, and large data set handling through rich media).

By End Use

In 2023, smartphones led the UFS market with a 54.6% share, as demand for fast, low-power consumption storage continued to grow for mid-to-high end devices capable of 4K video, game and AI functions.

Automotive electronics is projected to have the highest CAGR during 2024–2032, at leading levels with fast UFS adoption in ADAS, infotainment and digital clusters. This is crucial to connected, electric and autonomous vehicles in need of low-latency, high-performance capabilities, resulting in healthy growth in this market.

North America Leads, Asia Pacific Emerges as Fastest-Growing UFS Market

North America led the UFS market in 2023 with a 34.7% share, driven by strong demand from consumer electronics, automotive, and enterprise sectors. The region benefits from advanced infrastructure, high smartphone penetration, and early adoption of next-gen storage technologies. Key players like Apple and Tesla use UFS for enhanced performance, while OEMs invest in AI-enabled systems.

Asia Pacific is set to grow fastest (2024–2032), driven by an increase in electronics manufacturing, urbanization, and a strong semiconductor base in China, India and South Korea.

Do you have any specific queries or need any customized research on Universal Flash Storage Market? Submit your inquiry here @ https://www.snsinsider.com/enquiry/6648

Recent Developments:

- In Sept 2024, Samsung starts mass production of its 1TB QLC 9th-gen V-NAND promising 86% denser and 60% faster I/O speed than previous generations The chip has predictive programming and enhanced data retention and is aimed at targeted AI, mobile UFS, and enterprise SSDs.

- In May 2025, SK Hynix revealed its UFS 4.1 solution with 321-layer TLC 4D NAND The 7%-improved power efficiency and ultra-slim 0.85mm UFS 4.1 “dual companion” memory solution is promising to support on-device AI in flagship smartphones.

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. Universal Flash Storage Market, by Application

8. Universal Flash Storage Market, by Capacity

9. Universal Flash Storage Market, by Configuration

10. Universal Flash Storage Market, by End Use

11. Regional Analysis

12. Company Profiles

13. Use Cases and Best Practices

14. Conclusion

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company’s aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

CONTACT: Contact Us: Jagney Dave - Vice President of Client Engagement Phone: +1-315 636 4242 | +44- 20 3290 5010 (UK)

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. SingaporeOutlook.com takes no editorial responsibility for the same.

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. SingaporeOutlook.com takes no editorial responsibility for the same.